2021 outlook

Many 2020 events pushed into 2021, uncertainties on 2021 newsflow density remain

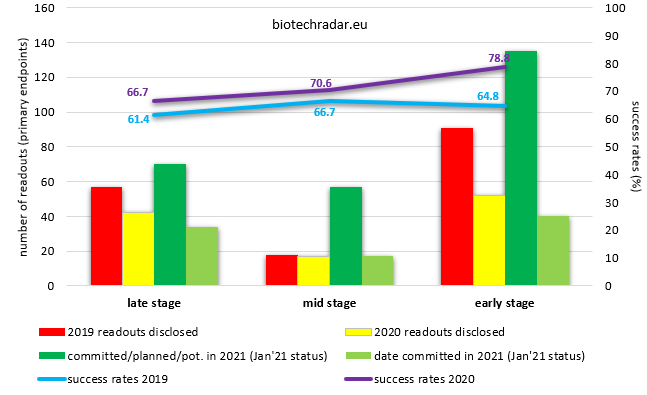

The figure below represents the number of clinical trials that yielded topline results (primary endpoints) in 2020 and those with topline results expected to be disclosed in 2021, with varying degrees of commitment in the timeline, especially in COVID times. As a reminder, a derating has to be applied to these 2021 figures, with typically 30 to 40% of the events of the last quarter (usually a busy one) shifting into the next year. According to our 2020 data to date, this derating could even be higher, and could impact most of the readouts planned for H2 2021, due to shifts relating to the difficulties to enroll study participants amidst the pandemic. Out of the 257 clinical events potentially delivering topline results planned for 2020 (as of early January 2020), only 114 were actually disclosed, corresponding to only 44% of the possible events estimated at the beginning of the year. The later stage, the higher rates of disclosure, which is somewhat expected since the incentive to conclude late stage trials is always higher: 55% for late stage trials, 43% for mid stage trials, and 36% for early stage trials.

During the Spring and Summer in the northern hemisphere, most of the clinical stage companies paused their clinical trials for 3 to 6 months, thus the high rates of delay for the readouts originally planned in 2020. Some companies closed the enrollment early, and others discontinued studies. In some cases, the readouts were performed but the results are still undisclosed (either because they are being analyzed, or due to data embargo because of a presentation at a scientific meeting, or because the communication is owned by a partner for whom the disclosure is not a material information -if it’s a publicly traded company-, or because it’s a private company or an academic organization).

Despite the uncertainties of these times, our numbers tend to indicate that there will be more early and mid-stage readouts in 2021 than in 2020.

and respective success rates (%)

The success rates were higher in 2020 than in 2019, for each stage, according to the definition of the primary endpoint(s) of each clinical trial. The difference at the early stage is explained by a different mix of phases (more phase 1x in 2020 versus 2019). The same applies for the late stage studies, where there were less dose-ranging phase 2b studies (the phase with the lower success rate, below 50%) in 2020 than in 2019. See more comments on success rates in last year’s review.

N.B. Early stage readouts include phase 1 to phase 2a trials, mid stage readouts include phase 2 trials (in a classical phase 1/2/3 development scheme), while late stage trials include phase 2b trials, phase 2/3 and phase 3 trials. Nonetheless, some phase 2 trials may be registrational, e.g. in oncology or for rare diseases.

2021, more approvals, and more launches!

After the 30 approvals out of 39 applications reviewed in 2020 (see the 2020 Highlights section), we count 30 applications already filed expecting a decision in 2021. 3 additional applications in H1 2021 could have a chance to be reviewed before the end of the year. Therefore, the total number of decisions should be stable or slightly down in 2021 versus 2020. Out of the 31 applications for 2021, 12 qualifies for “first-timer” reviews either in the US, Europe, or Japan. 1 additional “first-timer” review could be added in H1 2021. Again, the number of reviews falling into that category should be stable or slightly down versus 2020. 18 CHMP (EMA/EU), 9 PDUFA (FDA/US), and 4 Japanese NDA approvals (MLHW/JP) are currently expected in the course of this year.

Among the important approvals, one will watch the European approval of Mithra’s Estelle for contraception, the US approval of Zealand’s Dasiglucagon Hypopal for hypoglycemia events, Orphazyme’s US NDA of arimoclomol in NPC (and potentially at the end of the year in Europe), Oncopeptides’ potential Accelerated Approval of melflufen in RR MM, Poxel’s imeglimin in T2D in Japan via Sumitomo Dainippon, DBV’s (original) Viaskin Peanut for peanut allergy in Europe, Obseva’s linzagolix in Europe, Gensight’s Lumevoq in ND4-driven LHON in Europe, and last but not least, argenx’s efgartigimod in gMG in the US. Of note, Lumevoq could be the first gene therapy approved in a large jusrisdiction, for companies within our universe (European public biotech companies with main listing in Europe). Orchard Therapeutics (UK) already obtained the approval of Libmeldy in MLD but the company is only listed on Nasdaq, so it is outside our coverage.

If last year we highlighted an important wave of approvals in the items to look at, the logical next step is to follow the early launch trajectories of the newly approved therapies. Among those approved in the US last year, the most important ones are those of Morphosys/Incyte’s Monjuvi in 2L R/R DLBCL, and of PharmaMar/Jazz’s Zepzelca in relapsed SCLC. For those who wants an original case, they will look at the launch by Cassiopea of Winlevi, a prescription drug for acne for which the market seems to be ultra-bearish. One may also give a look at the launch of ByFavo for sedation by Acacia Pharma. For the European launches, it always takes more time since the reimbursement negotiations with the payers are longer and vary a lot from one country to another. The most interesting cases are those from Galapagos for Jyseleca in RA (also in Japan), and from Hansa’s for IDEFIRIX for the de-sensitization of highly-sensitized subjects undergoing a kidney transplant. Concerning Morphosys, one will also look attentively at the sales progression of Tremfya, since one should observe an acceleration of the sales and thus of the royalties, with the addition of psoriatic arthritis as an approved indication both in the US and in Europe.

Among the possible 2021 launches that could yield interesting indications with the early sales, one may mention Oncopeptides’ melflufen US launch that should occur in H1, if approved, with sales over H2. For Zealand, the US launch should also occur in H1, but the company spent the last months to manage the expectations for the short term. Finally, there’s the US launch of ponesimod in R/R MS by JNJ (royalties for Idorsia), though it’s not clear what the potential can since there are already 2 agents approved in the class (Mayzent and Zeposia, both S1PR agonists). If approved, the launch of arimoclomol will also be interesting to follow, since it addresses a rare disease. However, given the PDUFA date is in the middle of the year, the launch might not provide more than 1 full quarter of sales in 2021.

heADs or tails?

More globally, 2021 could see the most important drug approval of the decade, IF Biogen’s aducanumab is approved in Alzheimer’s Disease. And that’s a big IF. The credibility of the FDA is also in play here, at least until more well controlled randomized phase 3 trials with anti-ABeta agents give more credit to the “amyloid hypothesis”, since for those who followed the story and the AdCom in November of last year (votes 10 No and 1 Uncertain to the key question to the panel), the only reason why aducanumab even went so far in the regulatory process was an overwhelmingly supportive FDA. So, with a PDUFA date on 07/03/2021 (March), with a possible change at the head of the FDA with the new presidency, what will the FDA do? Stick to its crusader stance, or listen to the panel who basically asked for a confirmatory study? Or innovate with something original?

Some comments:

* 302 doesn't provide strong evidence of aducanumab effectiveness

* 302 is positive but 301 was crazy negative (uncertain vote)

* not clear if Abeta is the right target

* additional study w/ proposal of and RCT with randomized drug withdrawal pic.twitter.com/8OA3QkIDZQ— Bertrand Delsuc (@BertrandBio) November 6, 2020

All these considerations did not prevent the most intrepid investors to already start to speculate on the European biotech companies with anti-ABeta drugs for AD, among which: Bioarctic (BAN2401 as a “potential best-in-class” anti-ABeta, licensed to Eisai & Biogen, phase 3 running with results as soon as 2022), Morphosys (gantenerumab, a fully human anti-Abeta mAb, phase 3 running with results in 2022 for the GRADUATE program, and potentially 2021 for Marguerite-RoAD), Vivoryon (small molecule “targeting only the toxic forms of ABeta”, in phase 2), Alzinova (therapeutic vaccine approach against ABeta, preclinical but phase 1 planned in 2021), and finally Alzecure (small molecule, Gamma-Secretase modulator, preclinical). For Morphosys, the impact is smaller since the company has other fundamentals outside the AD program, which in addition is not fully-owned, conversely to its equally-shared Monjuvi in the US.

In conclusion, it’s hard to do more binary that the aducanumab event. One could also wonder if the decision, in one way or the other, could also have an impact for the sector, beyond Biogen and Alzheimer. In these COVID times, who knows?

Last comments

The pandemic will not be over before many months. Moderna CEO’s take at the JP Morgan Healthcare conference was that the pandemic could perhaps have less impact around the middle of the year in the US, and around the end of the year in Europe. Also, one has to remember that the pandemic is a global issue, not just a problem for the richest countries. It seems reasonable, but there’s no time to waste either. So, we can still expect that COVID-19 will fuel speculation on several companies, given the low level of progress on the therapeutic side.

Another point is that the massive inflows of liquidity seen on the markets in 2020 (e.g. 500 bUSD net inflow on ETFs) are likely to remain sustained in 2021. It even seems that we reached the point where there is so much money around, that the smart thing is to list… cash (with a purpose). If you are an investor, you cannot have missed the SPAC-mania occurring in the second half of last year. While we will not elaborate on the characteristics, the pros and cons of the SPACs (Special Purpose Acquisition Companies), they are an alternative to the IPOs, through a simple merger process with a target company, listed or not (it has to happen within a predetermined limited timeframe of 24 months). Like it was not enough, the SPACs -already gathering cash from the funds launching the SPAC- proceed to a normal IPO process to raise… more cash! According to the data from spactrack.net, there were more than 40 healthcare SPACs IPO’d in 2020 (43), of which 36 listed in H2 2020, and even 25 in Q4 (marking the crazy trend at the end of the year), with a total market cap of 13 bUSD, most of them waiting to find a target. To date, 9 have already reached a definitive agreement to merge with another company. We mentioned previously that the SPACs already shot a first arrow on the European public biotech companies during 2020, with UK’s 4D Pharma merging with the SPAC Longevity Acquisition Corporation, from a Chinese fund, and listed on Nasdaq. This SPAC was close to its maturity and absolutely had to find a target before being dissolved, so it was not part of the largest SPACs IPO’d during 2020. But you can be sure, there will be more. With more action on European companies? Otherwise, many European biotech companies have already expressed plans for a US IPO (dual-listing context), so 2021 might offer them a good window. With all these elements, 2021 should be another good year for the financing of the European biotech sector.

As another corollary of funds looking for new opportunities to put money to work, one may also expect to see more and more funds currently unexposed to the European biotech sector to be new entrants. There were many new names during 2020, and not only healthcare specialists. So, this is a positive trend, that hopefully will last, and even intensify in 2021.

One of the main curiosities for the European biotech sector will be to see if Galapagos can recover from their awful 2020 as soon as 2021. As you can see in our selection of catalysts, there will be some opportunities to reverse the trend, especially after the futility analysis of the ISABELA program. Of course, everything will depend on the quality of data. One may wonder if the small POC studies will allow the investors to really assess the full potential of the TOLEDO platform, but in a best-case scenario, things could go fast.

Concerning the deal activity, we noted that the Europe-China axis had been somewhat broken during 2020. With an increasingly favorable regulatory environment in China, it would be surprising not to see this axis yielding more deals, potentially with more interesting economics.

In conclusion, despite, and paradoxically, also thanks to the COVID-19 pandemic, the European biotech sector should keep gaining in maturity in 2021. The new financing means available will allow the sector to express its potential more easily than over the 2016/mid-2019 period. And even in case of reversal, what was taken is taken. Attention though, even in these “don’t fight the Fed” times (clear sky on rates until 2022 at least), there can always be bumps on the road.

Stay safe!

Selected key clinical catalysts in 2021 (not COVID-related)

Here is a selection of more than 30 readouts in 2021 (mostly for topline results / primary endpoints). The timelines are obviously not guaranteed. The list is not comprehensive (data to our best knowledge, at the date of publication of this post).

| Date * | Company | Catalyst |

|---|---|---|

| early'21 & pot. H2'21 | Isofol Medical | phase 3 - AGENT - arfolitixorin - CRC 1L: topline results = ORR & pot. re-powering if trend for PFS early in 2021, pot. PFS in H2'21 |

| early'21 | argenx | phase 2 (non-controlled) - CULMINATE - cusatuzumab - AML 1L (unfit for chemo): topline results = ORR for cusa+HMA => data disclosed on 08/01/2021 |

| mid-Q1'21/mid-Q2'21 | Erytech Pharma | phase 3 - TRYbeCA-1 - eryaspase - PDAC 2L: interim superiority analysis at 2/3 of events, final analysis H2'21 if superiority not found (no futility) |

| Q1'21 | Destiny Pharma | phase 2b - XF-73B07 - XF-73 - Prevention of Staphylococcal Infections after surgery: topline results |

| Q1'21 | XSpray Pharma | phase 1/3 (bioequivalence) - HyNap-Dasa - CML: 2nd bioquivalence study in HVs under fasted condition (the 1st one failed) => negative outcome disclosed on 14/01/2021 |

| Q1'21/H1'21 & H2'21 | Galapagos | phase 2b/3 - ISABELA1/2 - ziritaxestat - IPF: futility analysis when 500pts from both ISABELA 1/2 have reached wk52, topline results pot. at the end of H2'21 if not futile |

| ~ mid Q2'21 | ABIVAX | phase 2b - ABX464-103 - ABX464 - UC: induction topline results |

| Q2'21 | Polyphor | phase 3 - FORTRESS - balixafortide - HER2- BrCa: test if co-primary endpt = ORR leads to p<0.001 in n=300 |

| Q2'21 | Santhera | phase 2b - VISION-DMD - vamorolone - DMD: topline results of vamorolone vs prednisone vs pbo at 6mo |

| Q2'21 | ABIVAX | phase 2a - ABX464-301 - ABX464 -RA: topline results at 12wks |

| Q2'21 | Biophytis | phase 2b - SARA-INT - Sarconeos - Sarcopenia: topline results (gait-speed over the 400MWT) at 26wks |

| Q2'21 | XBrane Biopharma | phase 1/3 (bioequivalence) - XPLORE - Xlucane - Wet ARMD: topline results = non-inferiority testing vs Lucentis in BCVA at 8wks & 6mo data |

| pot. Q2'21 & Q4'21 | Cellectis | phase 1b - BALLI-01/AMELI-01/MELANI-01/ALPHA/UNIVERSAL - UCART22/UCART123/UCARTCS-1/ALLO-501/ALLO-715 - Hematological Malignancies: clinical updates of proprietary & licensed CAR-T canditates at scientific meetings |

| H1'21 | Orphazyme | phase 3 - ORARIALS-01 - arimoclomol - ALS: topline results at 76wks |

| H1'21 | Onxeo | phase 1b/2 - REVOCAN - etidaligide - Ovarian Cancer 2L: preliminary results = safety & biomarker |

| H1'21 | Oncopeptides | phase 3 - OCEAN - melflufen - Len-refractory RR MM: topline results = superiority or non-inferiority of melflufen vs pomalidomide |

| H1'21 | argenx | phase 2a - ADHERE - efgartigimod - CIDP: part A - go/no-go decision for part B |

| H1'21 | Faron Pharma. | phase 1/2 - MATINS - bexmarilimab - Selected Advanced Solid Tumors: first data of expansion cohorts |

| H1'21 (& pot. H2'21) | Celyad | phase 1b - CYCLE-1 - CYAD-02 (NKG2D auto-CAR-T with MICA/B knocked down by shRNAs) - R/R AML/HR MDS: clinical update of the dose escalation at a scientific meeting - pot. also in H2'21 |

| H1'21 (& pot. H2'21) | Celyad | phase 1b - IMMUNICY-1 - CYAD-211 (anti-BCMA allo-CAR-T w/ CD3z knocked down by shRNAs) - RR MM: clinical update of the dose escalation at a scientific meeting - pot. also in H2'21 |

| pot. Q2'21-Q3'21 | Galapagos | phase 1b - GLPG3667-CL-112 - GLPG3667 (undisclosed MoA) - Psoriasis: safety & early POC at 4wks in n=30 |

| pot. Q2'21-Q3'21 | Galapagos | phase 1a/b - CALOSOMA - GLPG3970 (SIK2/3 inh.) - Psoriasis: safety & early POC at 6wks in n=25 |

| pot. Q2'21-Q3'21 | Galapagos | phase 2a - LADYBUG - GLPG3970 (SIK2/3 inh.) - RA: safety & early POC at 6wks in n=25 |

| mid'21 | Galapagos | phase 2 - MANTA/MANTA-Ray - filgotinib - Autoimmune Diseases: topline results at wk13 & wk26 checking for male testicular safety - GLPG/GILD will not make a PR but will communicate the data to the regulatory agencies as companies will remain blinded (longer follow-up was requested by the FDA in some participants to check reversibility of pot. effect on sperm count) |

| mid'21 | Silence Therapeutics | phase 1b - APOLLO - SLN360 - Hyper/Dys-lipidemias in patients with elevated Lp(a): preliminary data |

| pot. Q3'21-Q4'21 | argenx | phase 3 - ADVANCE - efgartigimod - ITP: topline results |

| pot. Q3'21-Q4'21 | Galapagos | phase 2a - SEA TURTLE - GLPG3970 (SIK2/3 inh.) - UC: topline results at 6wks in n=30 |

| Q3'21 | Bone Therapeutics | phase 3 - JTA-KOA2 - JTA004 - Pain associated with knee OA: topline results (superiority of JTA-004 vs pbo and vs reference marketed product) |

| Q3'21 | OSE Immunother. | phase 1b - 1443-0001 - OSE-172/BI-765063 - Advanced Solid Tumors: first data of anti-SIRP-alpha OSE-172/BI-765063 in monotherapy & in combination with anti-PD-L1 BI-754091 |

| H2'21 | Quantum Genomics | phase 3 - FRESH - firibastat - Difficult-to-treat Hypertension: topline results |

| H2'21 | Nordic Nanovector | phase 2b - PARADIGME - Betalutin - R/R DL 3L: topline results = ORR |

| H2'21 | Erytech Pharma | phase 2 - TRYbeCA-2 - eryaspase - TNBC 1L: topline results = ORR |

| pot. H2'21 | Morphosys | phase 3 - contRAst-1/2 - otilimab - RA: topline results at 12wks |

| during 2021 | argenx | phase 1b - M19-345 - ABBV-151/ARGX-115- Advanced Solid Tumors: first data of the anti-GARP ABBV-151 in combination with AbbVie's anti-PD-1 budigalimab |

Disclosure:

Photo Credits:

Free for use images from, or adapted from pixabay.com and unsplash.