Highlights

2020, an extraordinary year for the financing of the European biotech companies

When it rains, it pours, the phrase says. Except that what rained on the sector in 2020 was money, the fuel of biotech companies that was so hard to gather for many of them in the past years. To illustrate this boom, according to our data for the past 3 years, the sector went from raising or securing funds in the total amount of 3.6 billion euros (bEUR) during 2018 (184 operations – all financing categories) to 5.5 bEUR during 2019 (227 operations – all financing categories, or 4.2 bEUR excluding the amounts from the Galapagos/Gilead outlier deal), and to 7.35 bEUR during 2020 (338 operations – all financing categories).

Even if the financing activity actually took off in Q3 2019 (see our monitors in the frontpage on our site), this is the profile of the companies who managed to raise or secure funding that changed. Indeed, in 2018, the number of operations below or equal to 5 mEUR was 86 in 2018 (46.7% of the operations – total raised/secured 142 mEUR), 113 in 2019 (49.8% of the operations) – total raised/secured 188 mEUR, and 182 in 2020 (53.5% of the operations– total raised/secured 328 mEUR). Some companies who were struggling to raise even a few hundreds of thousand euros, or a few million euros before 2020, managed to raise or secure millions, and in some cases even tens of million euros in 2020!

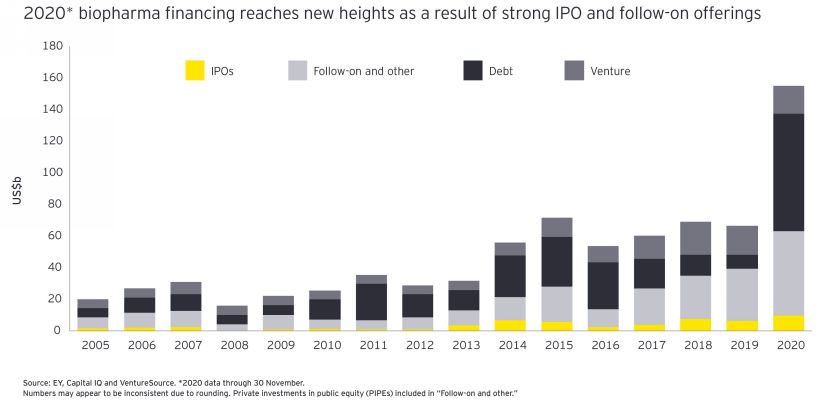

Qualitatively, the raises by equity offering (IPOs, and secondary/follow-on) increased from 2.8 bEUR (billion euros) in 2018, to 3.9 bEUR in 2019, and to record 5.4 bEUR in 2020. The amount raised or secured from dilutive schemes (various equity lines, warrants/options, convertible bonds) also progressed from 585 mEUR in 2018, to 700 mEUR in 2019, and to 1.5 bEUR in 2020.

Obviously, this boom cannot be completely de-correlated from the massive injections of liquidities into the system during 2020, along with the “Don’t fight the Fed” (or the Central Banks) and the global “risk on” attitude of the investors. There was also an impact of COVID, which led to a lot of speculation across the board, as many companies raised or secured funding in a more or less opportunistic manner during this period, based on their COVID programs.

Up to the sector to build on this momentum.

P.S. While we were writing this review, EY published their Annual Firepower Report. As one can see, the financing boom was global in 2020.

Bis repetita for argenx, signing again the largest secondary offering in European biotech history

Just after the successful phase 3 results of its lead program efgartigimod (FcRn antagonist) in gMG, argenx managed to beat its own record from November 2019, by raising 785 mEUR (vs 502 mEUR) in a secondary offering, under the form of a global offering of shares both in the US and in Europe. A record for our European universe.

As we mentioned in last year’s review, the Belgian/Dutch company aims at becoming the European “Alexion”, who was just acquired by AstraZeneca in December 2020 for 39 bUSD… Though, argenx still intends to become an independent fully-integrated biopharma company, primarily focusing its commercial strategy on serving the US and the Japanese market. Which led the company to strike a licensing deal for Greater China with Zai Lab just at the beginning of 2021. As disclosed by the CEO Tim Van Hauwermerein, the company will also have to find a partner in Europe.

While the cusatuzumab data unveiled at the beginning of this year look like an important setback, the future of efgartigimod seems bright. The BLA in gMG was filed in December 2020, waiting for the acceptance for review, with a potential launch in 2021. The ITP and PV/PF pivotal programs are on their ways to deliver data in 2021 and 2022, respectively. And the CIDP data, while early, will not have to be overlooked, since the CIDP positioning of efgartigimod is to be an “IVIg killer”. Finally, the company aggressively pushes its subcutaneous version (with or without Halozyme’s ENHANZE technology) in all indications. In 2020, TvH estimated that argenx had extended its lead over its competitors, because the phase 3 in gMG was completed before COVID had an impact on the clinical trials worldwide. We will see in the years to come if the FcRn keeps its promises, and if argenx can actually reach its goal of becoming a leading company in rare/autoimmune diseases like Alexion.

Genmab & AbbVie: a partnership for epcoritamab, and even more

The Danish biotech, originator of daratumumab/DARZALEX, the blockbuster drug and a backbone in multiple myeloma, delivered an impressive year in 2020. While Darzalex is expected to reach the 4 bUSD sales (or close to that) in 2020, via their partner Johnson & Johnson/Janssen, the migration of DARZALEX within DARZALEX -based combination regimens towards the frontlines or the earlier lines still has as strong traction. Moreover, the increased use of the subcutaneous version of DARZALEX (DARZALEX FASPRO) was expected to accelerate due to the COVID-19 pandemic (faster & more convenient administration, fitting with the maximum efficiency required in hospitals across the globe right now). Little cloud in the sky, with a dispute with JNJ on the royalties needed to be paid to Halozyme.

Among the other good news, Novartis had ofatumumab (formerly Arzerra in CLL & now Kesimpta in MS) approved in the US (the observers will have a look at how Novartis managed the life cycle of the product). Horizon has a strong launch for teprotumumab (TEPEZZA) in Graves Orbitopathy/Thyroid Eye Disease. A strong momentum partially interrupted by the collaterals on the manufacturing side, since the CDMO in charge of TEPEZZA manufacturing was requested by the US Government to prioritize the manufacturing of COVID vaccines.

But the hot topic in 2020 was the fate of epcoritamab, the company’s CD20 x CD3 Duobody. Indeed, Genmab believed the profile of epcoritamab was a potential best-in-class, even though acknowledging a delay versus its main competitors, Roche and Regeneron. “But the delay might not be as large as some think it is”, previously said Jan Van de Winkel, the company’s CEO, also communicating on the “military-like execution” of this program at Genmab. A clinical development with a lot ambition, also requiring the operational muscles and financial backing of a Big Pharma. Despite the lag, AbbVie entered in a licensing agreement with Genmab for epcoritamab, as it seems that epcoritamab could show a similar efficacy but with a better safety profile, thanks to its subcutaneous injection and its differentiated PK profile, alleviating parts of the concerns on cytokine release syndrome with these agents. This was actually substantiated by the last ASH data in December 2020, where epcoritamab suddenly on the map of some observers, whereas all the eyes were formerly on the Roche & Regeneron candidates. Of note, Genmab retained half of the rights in the US and Japan (50:50 profit sharing with AbbVie in these territories), also marking a change in the strategy of the company, which doesn’t only aim at receiving royalties anymore, but at keeping at least half of the value of its assets, as reiterated by its CEO over the past months. Thus, Genmab will build its own commercial operations. Additionally, and this was not particularly expected, AbbVie also took an option on GEN1044 (DuoBody-CD3x5T4), GEN3009 (CD37 DuoHexaBody) and for up to 4 additional antibody-based products, thus leading to a 750 mUSD (659 mEUR) upfront payment from AbbVie (total deal value 3.9 bUSD or 3.4 bEUR, largest deal of the year for the European biotech companies).

On the clinical side, the innovaTV 204 study of tisotumab vedotin (HuMax-TF-ADC) in R/M cervical cancer (in collaboration with Seattle Genetics) reached its primary endpoint (ORR). Both companies are preparing the filing for accelerated approval in this indication. They even started the confirmatory trial in the past few days, before the filing. 2 other programs attracted the interest of physicians and investors during the last ASH meeting: teclistamab (BCMA x CD3 Duobody) and talquetamab (GPRC5D x CD3 Duobody), both licensed to JNJ. Once again, Genmab was smart in their early clinical development, using the same “trick” as for epcoritamab, i.e. testing both an intravenous and a subcutaneous versions of their compounds. The first data presented in December were promising. And finally, the cherry on the cake, JNJ filed for amivantamab (EGFR x cMet Duobody) in metastatic NSCLC with EGFR exon 20 insertion mutations (after progression with Platinum-based chemotherapy), just based on phase 1b data (Breakthrough Therapy Designation already granted in March 2020).

Based on these results, the discontinuation of the AXL ADC program appears to be only anecdotical. Perhaps, one may have a more mixed take at the moment on the PD-L1 x 4-1BB Duobody (GEN1046/BNT311), for which the dose-escalation was completed in a record time, but the first expansion cohort data presented as ESMO, even though promising (signs of activity in anti-PD-1/PD-L1 experienced patients and in cancer types known not mostly refractory to PD-1 blockade), might be still be judged as quite early.

In 2020, Genmab confirmed its lead as the largest European biotech company (21.7 bEUR), with a stock price signing +66%. It will be hard to reiterate the same performance in 2021.

Morphosys: a foundational deal with Incyte for tafasitamab, but not what investors expected

At the end of 2019, the newly appointed CEO of Morphosys, Jean-Paul Kress, prepared the market for a licensing deal for tafasitamab, the company’s anti-CD19, combined with lenalidomide in R/R DLBCL. Indeed, even though no RCT had been run, the FDA considered the data of the L-MIND study were compelling enough to be reviewed for an accelerated approval in 2L R/R DLCBCL, setting for which there was no FDA-approved drugs. So, the market knew it was coming, and the market bought the deal, which was eventually announced for the JP Morgan Annual Healthcare Conference in January 2020, as it is the tradition for some of the most important deals in the sector.

But while the economics were impressive (650 mUSD upfront payment, 150 mUSD equity investment of Incyte into Morphosys, with 1.1 bUSD of “biodollars”), the profile of the partners surprised the investors and the analysts, mostly expecting a Big Pharma name. So, when they saw the name of Incyte, still a very respected biotech company, it just did not match the expectations. And in that case, there is a realignment downwards of the stock price. In fact, Morphosys had not been very vocal on the exact terms of the deal they were hoping to sign, especially on the fact that the company really wanted to co-promote tafasitamab in the US. This requirement was probably a key point that made a deal with a Big Pharma unlikely… But this deal also acted a complete change in the strategy at the German biotech, who was more used to ink out-licensing or global research deals with Big Pharma companies. Now, the company would build its commercial operations to sell its first product directly (50:50 in the US, but booking all the US sales). In fact, it seems that the market did not interpret the appointment of Jean-Paul Kress correctly, since he did not join the company to sign an n-th out-licensing deal like Morphosys signed in the past, but to transform it into an integrated biopharma company.

Now, Morphosys still has a newsflow inheriting from his partnered programs (e.g. with otilimab from GSK or with gantenerumab from Roche), but they also want to build on tafasitamab as a backbone to expand into the frontline DLBCL and in other indications, notably by combining tafasitamab with Incyte’s PI3K delta inhibitor parsaclisib in CLL. The German biotech is also seeking to strike bolt-on deals. They are notably interested in the CD47 axis, as they have seen synergies to increase the ADCP with tafasitamab, but the prices of the assets in this class are currently very high. They tried to evaluate an alternative approach from Vivoryon but the preclinical evaluation was seemingly not at the level of what they had hoped for. They even contracted a 325 mEUR convertible bonds program in last October, to increase their “firepower”. So, we should not be surprised if Morphosys tries to deploy some cash in business development in 2021. In parallel, Morphosys also adds complementary technologies to its own discovery platform, as recently with Cherry Biolabs for the Hemobody construct. Finally, Morphosys is also open to collaborate with third parties, still building on tafasitamab, as illustrated with their collaboration with Xencor, to combine tafasitamab/lenalidomide combination with Xencor’s CD20 x CD3 plamotamab.

Morphosys and Incyte recorded 5mEUR sales in the US in Q3 2020. When an analyst asked what the company hadn’t planned or what the company had to adapt to for the launch, the CEO simply replied “COVID” (or how to launch a drug in the COVID era, how to engage stakeholders remotely, etc). Also, it seems the peak sales guidance of tafasitamab (Monjuvi) by Morphosys was below what the analysts has priorly modelled. However, the early figures seem decent. So these figures will obviously of interest in 2021.

In terms of newsflow, Morphosys intends to launch a pivotal study in frontline DLBCL for tafa-len and R-CHOP. Another pivotal study in R/R FL should be launched. There should be some news from GSK for otilimab in COVID-19 (large phase 2 RCT) and in RA (phase 3). JNJ should also provide the phase 3 results of guselkumab (Tremfya), for which Morphosys received 32 mEUR or royalties in 2019 and likely around 40 mEUR in 2020, in psoriatic arthritis (patients with inadequate response to anti-TNF-alpha agents) and in palmoplantar-non-pustular psoriasis. Finally, whereas the GRADUATE phase 3 program in early/prodromal AD should read out in 2022, it is not clear whether the phase 3 results of the MARGUERITE-RoAD study of Roche’s gantenerumab (anti-ABeta) in Mild AD could yield results in 2021 (Q2’21 readout indicated), with results likely to be presented at a scientific meeting. Low expectations but in the interim, the field should already be fixed on the aducanumab case…

Morphosys ended 2020 as the 6th largest market cap (3.1 bEUR) among the nano-smidcap biotech companies mainly listed in Europe.

The highest number of approvals in the 3 main territories

30. This is the number of approvals in the US (FDA), Europe (EC, after EMA’s centralized procedure only), and Japan (MHLW) during 2020, and up from 11 in 2019. A record for our universe of listed European biotech companies. Out of 39 applications reviewed during 2020 in these top 3 territories (77% approval rate), and in line with the higher end of our estimate of 29 already planned decisions, with up to 11 additional decisions potentially coming on top. This was a strong progression that we expected from the 15 reviews (counting the Ablynx US application) during 2019 (73% approval rate), see our review last year. For 2020, 5 applications were rejected and the remaining 4 applications were withdrawn by the applicants.

Concerning the “first-timers” (companies with their first drug approved in either the US, Europe or Japan – status counted once for each territory), we counted 15 such cases in 2020 (12 plus 4 in our projections last year), from only 5 in 2019, another record. The approval rate was 3/5 or 60% in 2019, and 10/15 or 66.7% in 2020, which is lower than the overall approval rate and well below the industry average. This can be explained by a lower experience versus the large biopharma companies e.g. to manage the CMC/manufacturing part (a common weakness according to the reasons for CRLs), and the fact that some companies in our landscape (notably Genmab with the multiple supplemental/Type II variation applications for Darzalex), drive the numbers up.

Indeed, Genmab collected 6 approvals in 2020, 5 for Darzalex via Janssen/JNJ, and one for TEPEZZA in the US via Horizon. Galapagos had Jyseleca approved in Europe and Japan, but not in the US (Gilead had even used a PRV for that CRL!). Good year also for Morphosys, with the approval of Monjuvi in the US, and 2 for indication extension of Tremfya via Janssen/JNJ. PharmaMar obtained an Accelerated Approval for Zepzecal in SCLC. Outside the CRL of Jyseleca in the US, the other rejections were from AbbVie (via Allergan) for abicipar pegol in wet ARMD (CRL), DBV Technologies for Viaskin Peanut in peanut allergy (CRL), Vectura via Hikma for Advair Diskus generic (“minor” CRL but approved later on), and Mithra via Mayne Pharma for Myring (Nuvaring generic) contraceptive ring (CRL).

The "Billion Euro Biotech Club" almost doubled in size in 2020

The number of European listed biotech companies with a market superior of at least 1 bEUR at the end of each year has always oscillated between 8 and 10 over the past 5 years. The total market cap of the “billion euro” biotech club really took off in 2019 at 45.5 bEUR (+76% from 25.8 bEUR in 2018n under the impulse of Galapagos, Genmab and argenx), and progressed again by 38% in 2020 (62.9 bEUR, mainly thanks to Genmab and argenx, and despite the fall of Galapagos), with 16 companies at the end of 2020 instead of 9 a year before.

The Top 20 market caps can be found in the Table below. The new entries in the club in 2020 were Vaccibody (newly listed in Oslo), Bavarian Nordic (DK), PharmaMar (ES), Oncopeptides (SE), Hansa Biopharma (SE), Cellectis (FR), AB Science (FR), Camurus (SE).

| Company | Country | Market Cap (m€) | |

|---|---|---|---|

| 1 | Genmab | DK | 21694.9 |

| 2 | argenx | BE | 11456.8 |

| 3 | Galapagos | BE | 5264.3 |

| 4 | Evotec | DE | 4963.3 |

| 5 | Idorsia | CH | 3929.3 |

| 6 | Morphosys | DE | 3085.7 |

| 7 | Vaccibody | NO | 2037.5 |

| 8 | Bavarian Nordic | DK | 1468.8 |

| 9 | PharmaMar | ES | 1303.2 |

| 10 | Cosmo Pharma. | IT | 1182.2 |

| 11 | Zealand Pharma | DK | 1179.9 |

| 12 | Oncopeptides | SE | 1146.9 |

| 13 | Hansa Biopharma | SE | 1097.6 |

| 14 | Cellectis | FR | 1037 |

| 15 | AB Science | FR | 1024.6 |

| 16 | Camurus | SE | 1005.6 |

| 17 | Oxford Biomedica | UK | 948.1 |

| 18 | Indivior | UK | 892.6 |

| 19 | Mithra Pharma. | BE | 841.5 |

| 20 | BioArctic | SE | 835.7 |