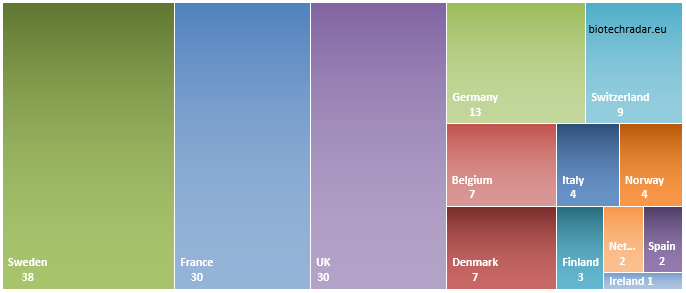

1.1 Companies by country and by stock exchange

As shown on Figure 1, Sweden is the largest provider of biotech companies in our universe, before France and the UK at the same level. Germany is only ranked fourth. Switzerland, the home of 2 European Big Pharma, arrives in fifth. Then follow Belgium and Denmark, 2 very strong places despite their ranking. Finally, Italy and Spain, 2 members of the EU5, have a limited number of biotech companies listed on the European markets, more or less at the same level as the Scandinavian countries like Norway and Finland, and a single company from Ireland.

Such a gap between Sweden (10m inhabitants) and much larger countries (> 60m) might come as a surprise for those who do not follow this space. In fact, Sweden is almost an ecosystem on its own inside Europe. In addition, biotech companies tend to list very early in the markets (with respect to their development stage), much sooner than everywhere else actually. In addition, we only included companies listed on Nasdaq OMX Nordic, but there is another platform on which many companies start listing as public companies, before being transferred to the Nasdaq OMX markets later on. This other platform is the Spotlight platform, formerly known as Aktietorget, allowing companies to list for a small price. Therefore, many Swedish companies floated on Spotlight first, then migrated to the secondary “growth” market of Nasdaq OMX (the First North market). For those reaching even higher valuations, they can finally end on the Nasdaq Nordic List, attracting more investors. Other factors may characterize the Swedish ecosystem: retail investors who are seemingly keener on taking risks than the European average, a well-developed market access, a flow of corporate communications above average, a well-known transparency culture and diligence in reporting. All these elements lead to a favorable environment in this country, at least for the earliest stages. Though, the question of the financing of all these companies will remain for the mid-term, as some of them will move forward into advanced stages, requiring way more funds.

On the other extreme, one might find curious to see so few companies in Italy and Spain. There are many Pharma companies in both countries, public and private, but these countries are not hotspots for the public biotech sector, as of today. However, academia is generally strong in these countries, and some institutions are renowned, so this is not a matter of scientific level. The local ecosystems seem relatively young there, some regional biotech clusters (within the countries) are 10 years old or less. Lastly, most of the Italian companies in our selection played the card of the proximity with specialized investors, by choosing a listing in Switzerland, more than in Italy. This clearly demonstrates a lack of financing support in their home markets. So, is it just a matter of time before the rise of biotech in the south of Europe? Time will tell, but the road will probably be long enough.

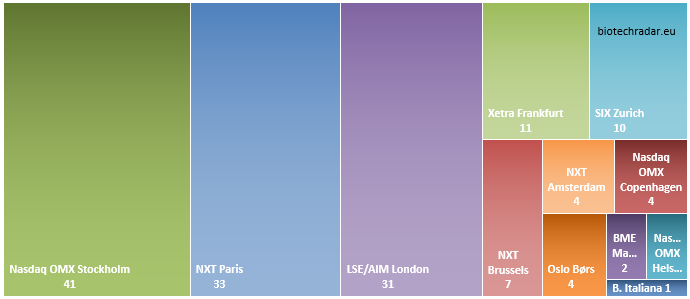

In accordance with Figure 1, we find again the 3 main clusters -Sweden, France, UK- when looking at the main stock exchanges (Figure 2). As mentioned just before, the country of origin of the companies does not always correlate with the place where it is trading. This is indeed mostly the case (91%), but not always. 3 Italian companies out of 4 are listed in Zurich, 1 German company and 2 Swiss companies are listed in Paris, 1 British company is listed in Brussels, 1 German company is listed the Netherlands, 1 Finnish company is listed in London, 2 Danish companies are listed in Stockholm, and Galapagos (Belgium) is listed in Amsterdam (ok, Belgium and Netherlands are really close!). Finally, we consider Amryt as an Irish company that is dual-listed in London (AIM) and Dublin (Euronext), but we assigned the main listing as being in London, notably based on trading volume considerations.

The main reasons for these re-locations are, first, a better access to financial resources expected in the targeted listing places, and second, merger and acquisitions, not from the biotech companies but from the stock exchanges. Indeed, Euronext has been very active on M&A in Europe lately: following the acquisition of the Irish Stock Exchange at the end of 2017, the pan-European group just completed the acquisition of Oslo Børs mid-June 2019, after a bidding war with Nasdaq OMX. So, the lead of Euronext will extend again. XETRA (Deutsche Börse) and SIX both host heavyweight biotech companies, but are way behind in total number of companies. Quality over quantity? Or just more pragmatic markets there, less prone to sectorial hype cycles?