In this short post, I propose a quick snapshot of the M&A transactions Centerview have been involved in, during 2023 and 2024, to show by the data that the biopharma acquisitions are their forte.

As the WSJ reported yesterday, the shareholders of Centerview Partners are exploring the sale of a stake in the boutique bank. Centerview is a well-known financial advisor, involved in many biopharma M&A's of late, especially on the acquisition side. Their leadership on the sizeable acquisitions of US public bios is remarkable. The biopharma sector is not their only area of focus, but that's their stronghold, as noted in the WSJ article. There is an interesting chart in the story showing that the revenue per employee is basically 2.5x higher than the closest competitor in this boutique bank area, making them 'special'.

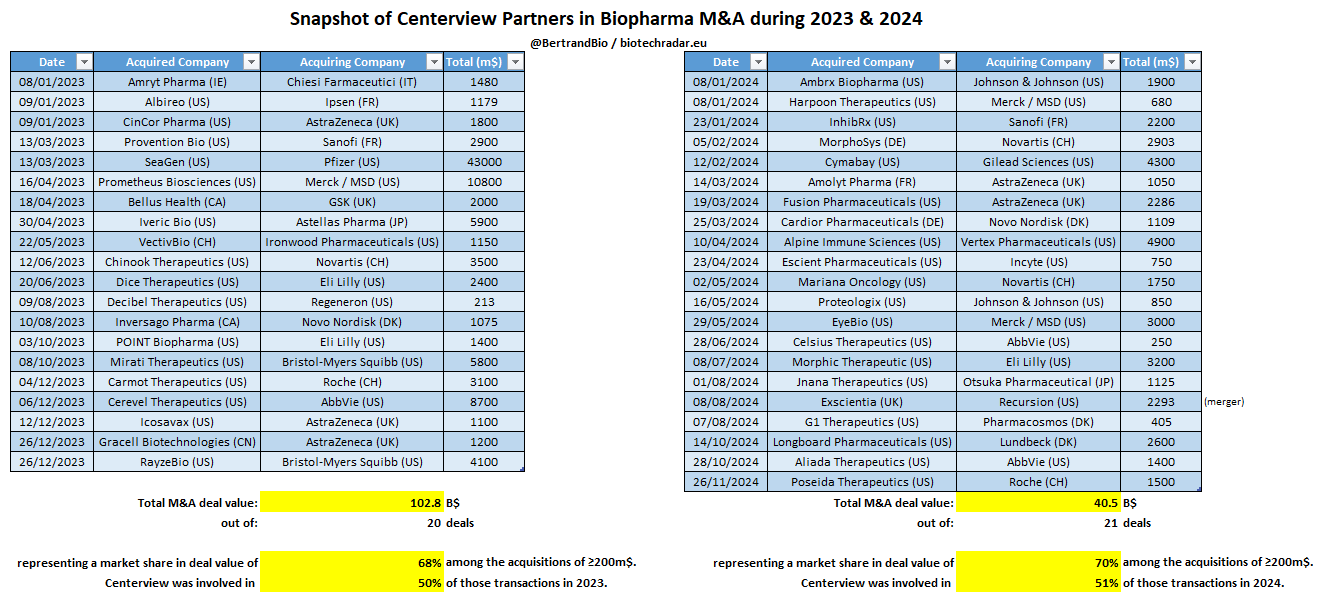

According to my data, over the last couple of years, Centerview was involved approximately half of the biopharma acquisitions with a total deal value (TDV) of 200m$ or higher (excluding non-therapeutics deals). The aggregated TDV of all the acquisitions they advised reached more than 100B$ over 20 deals in 2023. This amount decreased to around 40B$ over 21 deals in 2024, which was sort of a 'back-to-normal' year, M&A-wise for the sector. Still within that perimeter, around 70% of the aggregated TDV were from acquisitions they advised. Which is the lion's share, and basically means that their competitors have to deal with what they leave them.

With tens of billions of pharma revenues at risk in the next decade, a good chunk of these revenue gaps may be filled organically, but also with business development. M&A is part of the DNA of this business, so it will not stop completely tomorrow. Thus, it is not surprising to see some investors being interested by taking a stake in this leading boutique bank. A deal would also allow the historical shareholders to secure some of their returns.

Though, since 2023, we also see more earlier in-licensing deals inked by the big pharma companies. Notably with a trend to look at Chinese assets. These early licensing deals may not be a solution for the next patent cliffs expected to occur in the short term, but they may still impair the US M&A activity in the mid or long term. This is by assuming that those assets will cross the finish line with a good probability. Alternatively, if the impact on the valuations in the US is too negative, these Chinese deals could also participate to keep the US attractive.

Overall, these potential headwinds on the biopharma sector makes the diversification of the activities at Centerview to other sectors as a key element, as mentioned in the WSJ article.

Ad hoc analysis:

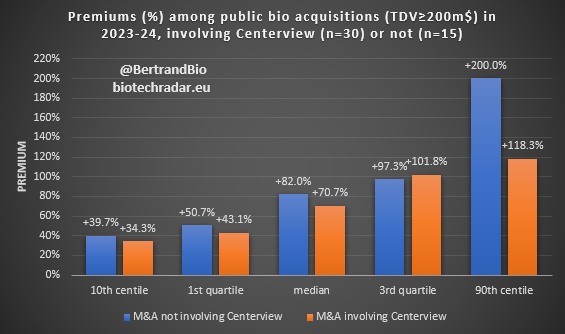

Beyond those telling numbers, one may ask whether the stock price premiums obtained for these acquisitions (by definition, of public biopharma companies) advised by Centerview were potentially different (e.g. higher) than those obtained with other advisory firms. The chart below represents the distribution of the premiums for the acquisitions of total deal value (TDV) of 200m$ or higher, when advised by Centerview (n=30) or not (n=15), over 2023-24.

The data show that the median premium is slightly lower for the biopharma acquisitions advised by Centerview. It is also true on the lower end of the distribution (10th centile and 1st quartile), but not for the 3rd quartile. The interpretation of the 90th centile seems limited by the small sample in the pool of transactions not advised by Centerview (n=15). The upper tail of the distribution is not well defined for this data sample, due to the discretization. This remark is also valid for the 10th centile, but the sample is seemingly more consistent on the lower tail here.

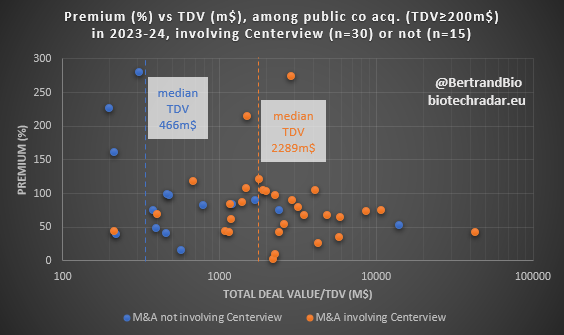

However, as described in prior comments, and as shown on the chart below, the typical size of the deals advised by Centerview is much larger than for the deals advised by peers. And the premiums usually follow a decreasing trend, when the size of the deals increases. One may attribute that to lower risk discounts for the larger companies in the biopharma sector.

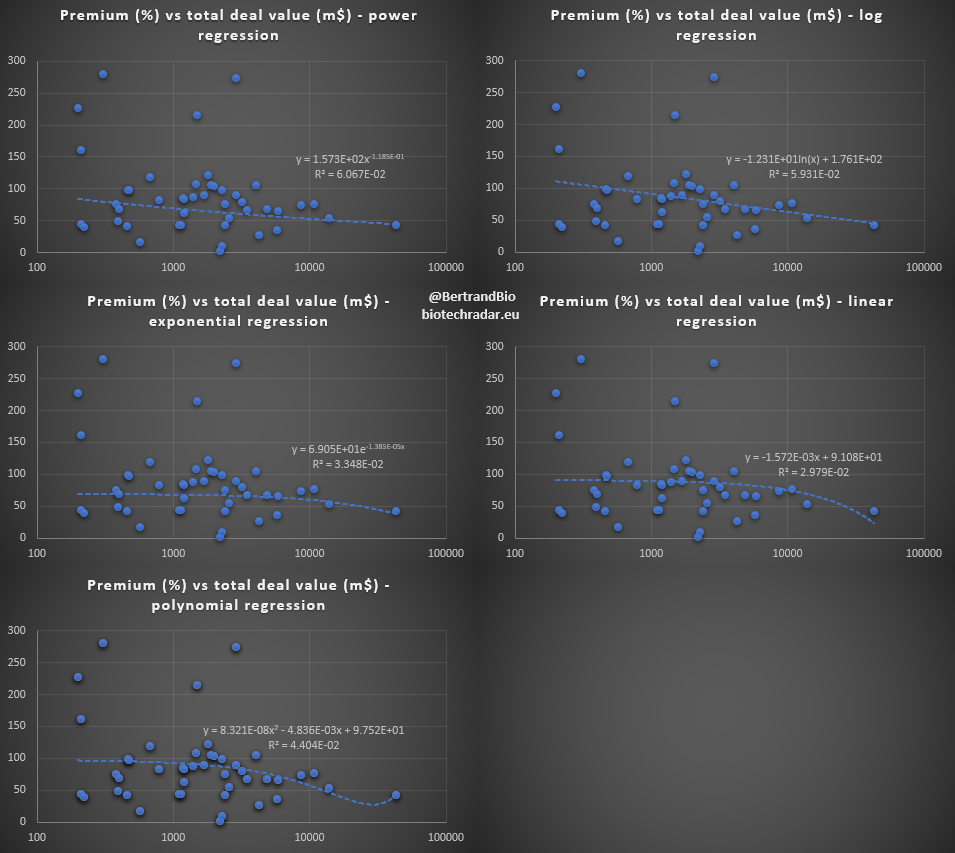

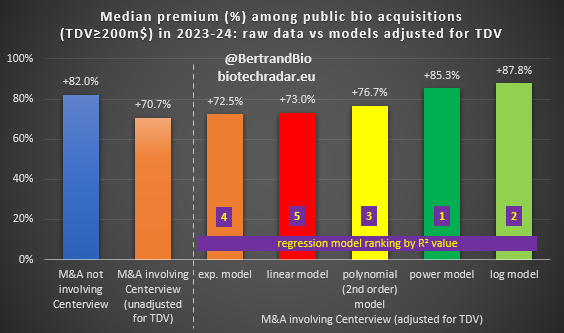

When using the simple regression models available in Excel, we can indeed isolate the trend mentioned above, whatever the model used.

After adjusting the median premium data with the different models, based on the same median total deal value (TDV) as for the transactions not advised by Centerview (466m$, vs 2259m$), the median premiums obtained with the most relevant models (or less irrelevant, given the low R-square values) end up in the same area as the reference: from +77% to +88% with the Top 3 models, up approximately 6-17pp from the ~71% without adjustment for the median deal size. This mid-point of this range is also similar to the reference of a +82% median premium, for the acquisitions advised by other boutique banks.

In conclusion of this ad hoc analysis, it does not seem that the premiums obtained with Centerview are any different than those obtained with other advisory firms. Therefore, the leadership of Centerview is likely due to other factors.

As seen with the quick snapshot, their track record in the recent past speaks for itself. Therefore, the larger companies seeking a trusted third-party advisory firm may be more inclined to go to Centerview first, with their undisputed leadership, their level of expertise, their extended network to reach potential acquirers, their knowledge of processes and legal framework, etc. They know how to work with the Boards to establish financial projections that would be credible for acquirers, although the most of the key model inputs usually come from the Boards and the company executives, according to the many SEC filings of the acquired companies I have parsed. One has to give them credit for having built such a strong momentum.

One point is that we do not know when the deals do not close, i.e. we do not know if the 'success rate' with Centerview as advisors is higher than with competitors. Recently, Centerview advised Halozyme for the unsolicited takeover of Evotec, which was eventually withdrawn weeks later. This is one of the rare public disclosures where a projected acquisition advised by Centerview was unsuccessful. There are probably many others, both at Centerview and their peers. We just do not know if Centerview has an edge there.

Post by Bertrand Delsuc (@BertrandBio on X)